EU sustainable finance regulation

Explainer for a complex ecosystem

What is being regulated and why?

Before exploring the regulatory framework, we must first understand the dynamics of the system upon which it is built...

In support of the European Union's (EU) Green Deal initiative, which seeks to make Europe the first net-zero continent, regulatory reform aims to realign private capital towards ‘greener’ or more sustainable areas of economic activity.

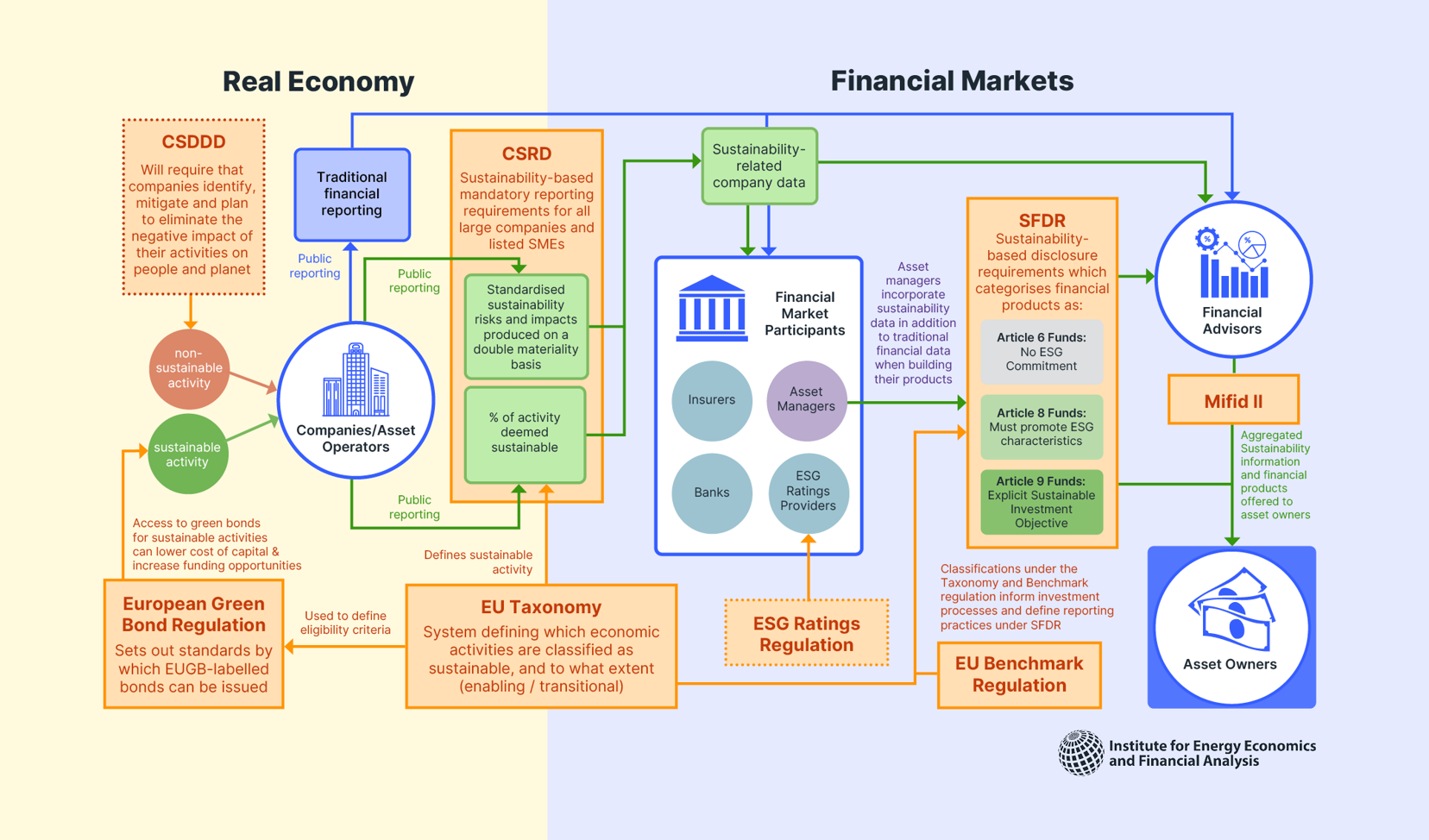

The financial system is at times complex, but ultimately, the stakeholders and relationships that regulation seeks to enhance can be simplified as seen here.

The real economy, comprised of companies that own and operate assets and engage in different types of economic activity, sits at the start of the chain

Information flow about the companies and their activities is passed to financial market participants (such as insurers, banks and asset management houses).

In terms of onward capital flow, asset managers use the information collected to base investment decisions and build portfolios.

Prior to mandatory sustainable financial regulation, this would have been based almost entirely on financial and economic data.

Aggregated investment vehicle information is passed to financial advisors / investment consultants.

In turn, this stakeholder group recommends investments to potential asset owners, based traditionally on the asset owner's appetite for financial risk and strategic preferences.

Asset owners, from individual retail investors through to the world’s largest pension funds, sit at the end of the chain. They allocate capital based either on advice or through their own decision-making processes.

Traditionally this was with little or no regard for sustainability preferences.

The underlying dynamics look simple, but enforcing transparency on sustainability issues in order to facilitate the flow of capital to more sustainable economic activity is far from it.

Meaning this, becomes.....

more like this...

Breaking down a complex ecosystem

Understanding the pillars of a regulatory framework

To build understanding, we can break the framework down into its components. This allows us to examine why each piece of legislation is important and how they fit together. The functioning of the system relies not on any one piece of regulation, but a holistic approach.

The Corporate Sustainability Reporting Directive (CSRD)

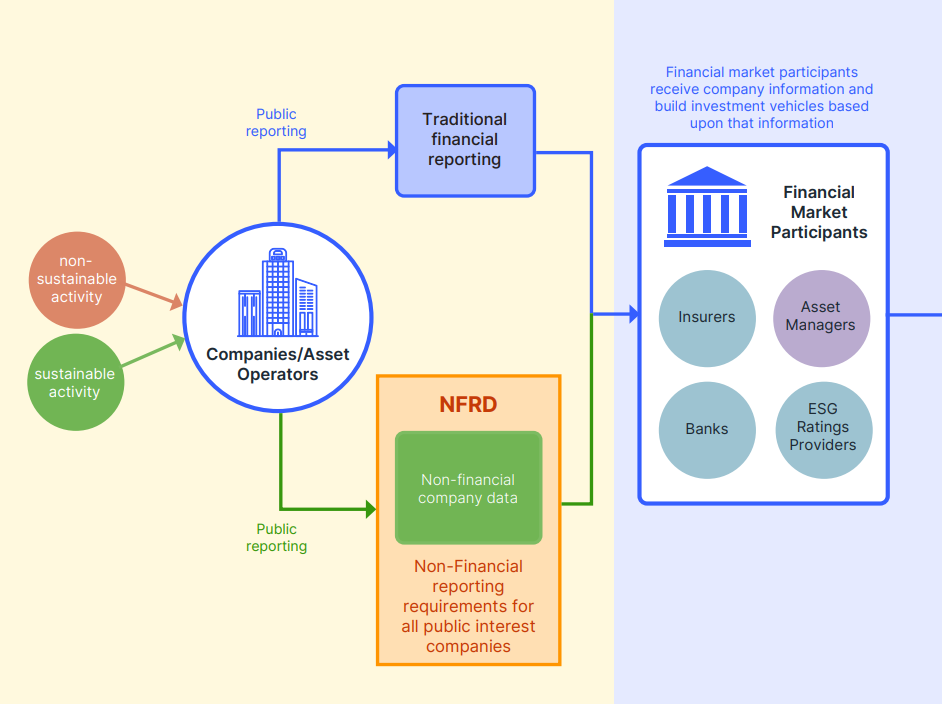

Before 2014, sustainability reporting at the EU level was voluntary. This changed when the Non-Financial Reporting Directive (NFRD) was adopted by all EU states, requiring the largest 'public interest' companies publish non-financial data including sustainability information, affecting around 12,000 companies.

With the adoption of NFRD, sustainability-related information became part of the information flow, albeit for only the largest companies:

NFRD: green shoots of sustainable financial regulation in the EU

NFRD: green shoots of sustainable financial regulation in the EU

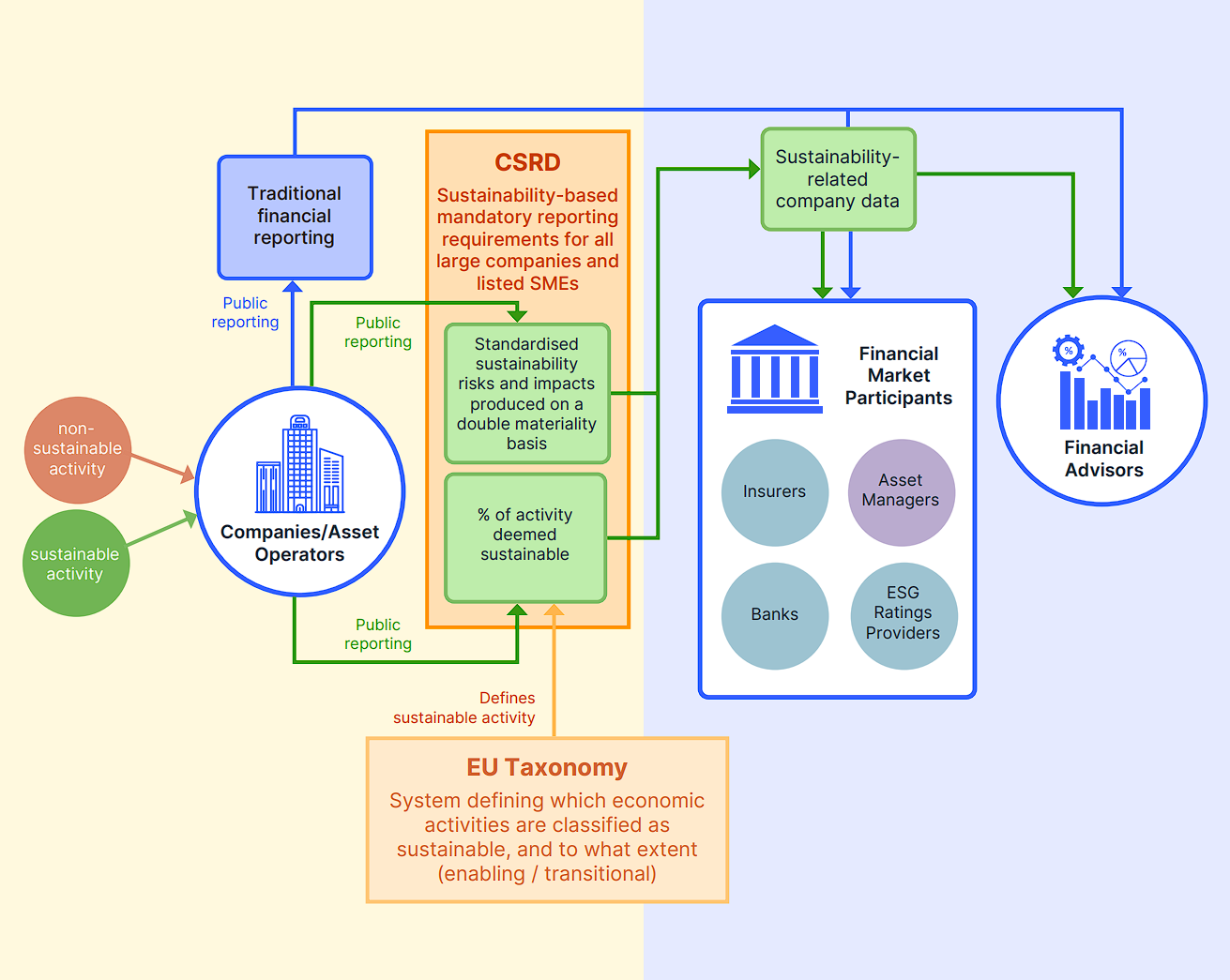

CSRD can be seen as the successor to NFRD and as the building blocks of the transparency framework. CSRD expands the scope of NFRD by mandating the standardised publication of environmental, social and governance (ESG) indicators at a company level, based on the underlying activities of a company, on a double materiality basis and for a much larger number of companies.

This means that the vast majority of large and / or listed companies must consider and report on not only the ‘outside-in’ impact of sustainability issues on the company from a financial perspective but also the ‘inside-out’ impact that company may have on the world around it. Estimates put the number of companies affected at around 50,000 by the time the directive is fully phased in.

As highlighted below, the EU taxonomy feeds in to and plays a significant role in shaping the data companies must produce under CSRD, highlighting one simple example of interdependency.

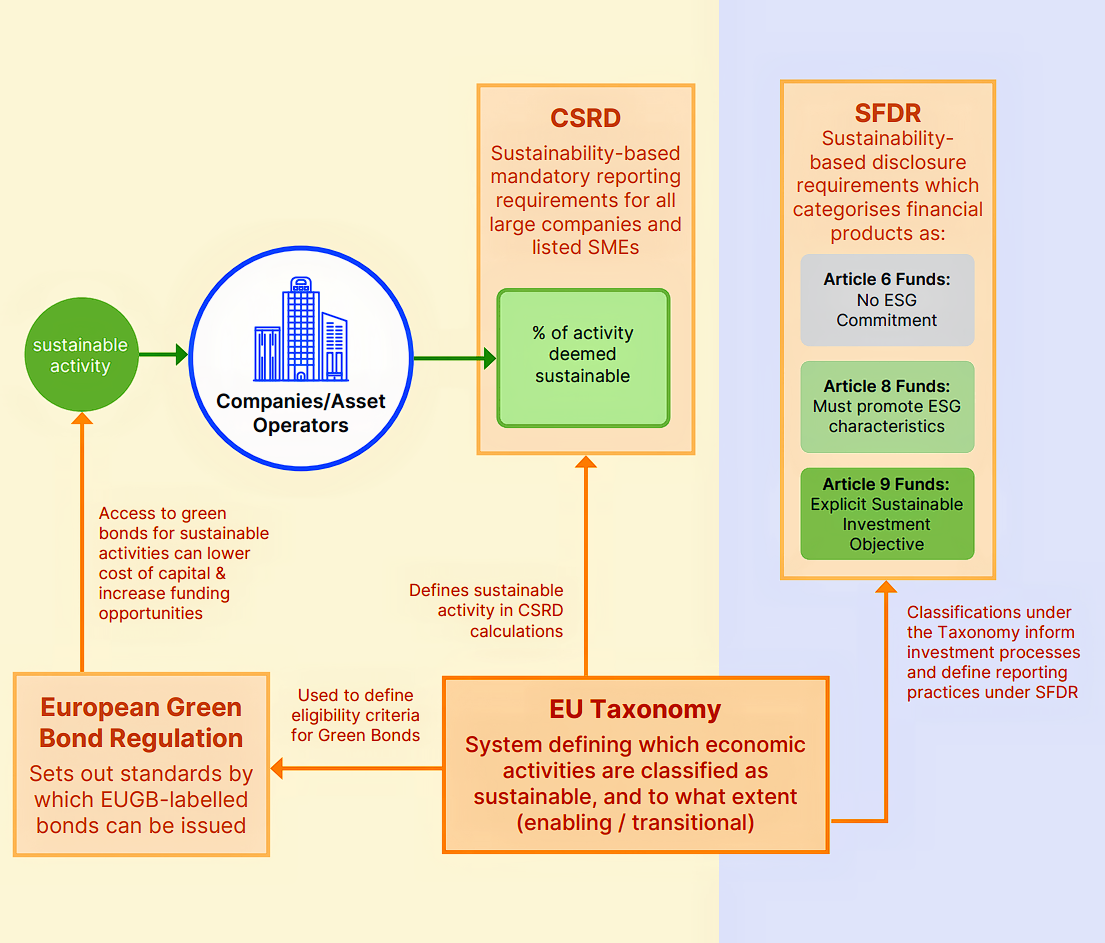

Interdependency: CSRD and the EU taxonomy (simplified relational chart)

Interdependency: CSRD and the EU taxonomy (simplified relational chart)

Without the EU taxonomy, a core data point in CSRD would be left undefined. So what is the taxonomy and how does it fit in?

The EU Taxonomy

The EU taxonomy is the cornerstone of the EU’s sustainable finance framework and an important market transparency tool. Put simply, it is a classification system that defines criteria for economic activities that are aligned with a net-zero trajectory by 2050 as well as broader environmental goals. It gives clear guidance as to what can be determined as a sustainable activity, and to what extent (enabling or transitional).

How does this fit in the wider architecture? The taxonomy is a tool for all stakeholders to use when making informed decisions, and so the applications are broad. Examples of interdependencies with other regulations can be seen below:

The EU Taxonomy: Underpins other legislation and mechanisms (simplified relational chart)

The EU Taxonomy: Underpins other legislation and mechanisms (simplified relational chart)

Its importance to CSRD has already been touched on, but other legislation leans heavily on the EU taxonomy. The European Green Bond Regulation, which aims to set out standards by which bonds can be labelled as ‘green’, thus potentially lowering the cost of capital and opening up new funding opportunities for companies, is one clear example. SFDR also relies on the classifications set out by EU taxonomy.

Sustainable Finance Disclosure Regulation (SFDR)

Although often mis-used as an ESG labelling system, SFDR is designed as a transparency framework through which asset managers can determine appropriate sustainability disclosure levels for their funds and obligates the standardised publication of ESG credentials at both a product and entity level.

In simple terms, if the objective of regulation is primarily to align private capital flows with sustainable areas of economic activity, SFDR in many ways is the end goal. SFDR delivers metrics that underscore the sustainability ambition of products offered to potential investors, as well as information on the sustainability profiles of the managers operating them.

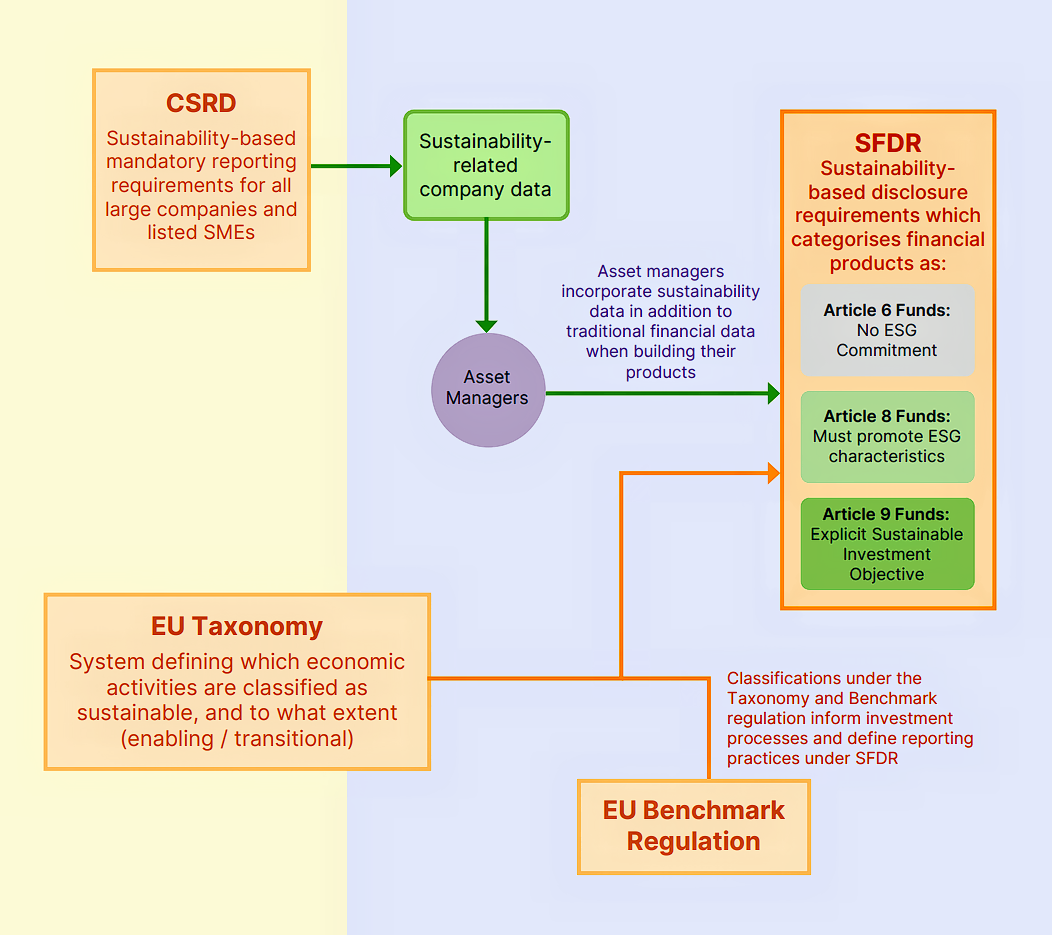

SFDR gives asset owners the information required to make investment decisions based on not only financial data but also sustainability issues by leveraging the groundwork done by other legislation such as CSRD and the EU taxonomy:

SFDR: In many ways the end goal for transparency (simplified relational chart)

SFDR: In many ways the end goal for transparency (simplified relational chart)

As seen above, at the heart of SFDR is a system of categorisation whereby a financial product must be qualified by the offering manager as Article 9, 8 or 6. The higher a fund's commitment to integrating sustainability issues the higher the categorisation, which in turn dictates the level of sustainability-related disclosure required.

Granular data collected on investee companies through CSRD is crucial in this process as it allows asset managers to build and report accurate aggregate ESG credentials. The EU Taxonomy and EU Benchmark Regulation also contribute to this process as, for example, Article 9 funds must only contain investments that are deemed as 'sustainable'. Such investments may be defined as such by the taxonomy or through investing only in constituents of sustainably aligned benchmarks.

The Corporate Sustainability

Due Diligence Directive (CSDDD)

So far, we've reviewed the roles of what are often described as the three main pillars of EU sustainable finance regulation: CSRD, EU taxonomy and SFDR. Each of these pillars builds toward creating and fostering transparency, which standard setters believe will allow capital to better align with areas of sustainable economic activity. Whether or not transparency alone is likely to be enough to meet the expectations of net-zero ambitions, however, is debatable.

As seen on the regulatory overview diagram, CSDDD, on the other hand, looks to target the behaviours and negative externalities of the activities companies undertake. It will require companies put in place plans to identify, mitigate and ultimately eliminate their negative impact on people and the planet. CSDDD aims to foster sustainable and responsible corporate behaviour and to anchor human rights and environmental considerations in companies’ operations and corporate governance. New rules will ensure that businesses address adverse impacts of their actions, including in their value chains.

Source: European Commission, IEEFA as at November 2023

Putting it all back together...

The regulatory landscape is highly interdependent and relies on harmonisation of approach across directives. It is worth noting that the EU is an early adopter in this space meaning that much of the legislation is the first of its kind. As a result, we can expect refinement over time as the industry adjusts. IEEFA will continue to monitor developments as part of its mission to accelerate the transition to a diverse, sustainable and profitable energy economy.